At present, due to the promotion of e-commerce policies, the rapid development of several mobile operators, the emergence of various e-commerce platforms and so on, e-commerce has become an important channel for the sale of health food. Besides, the rise of CBEC (cross-border e-commerce), the improvement of logistics networks, and the trust of consumers in the quality of imported products also make foreign brands occupy a unique position in China. Take Tmall as an example, according to the top 20 health food brands of 2017, domestic brands and foreign brands account for half of the total respectively.

1. Overview of E-commerce Data

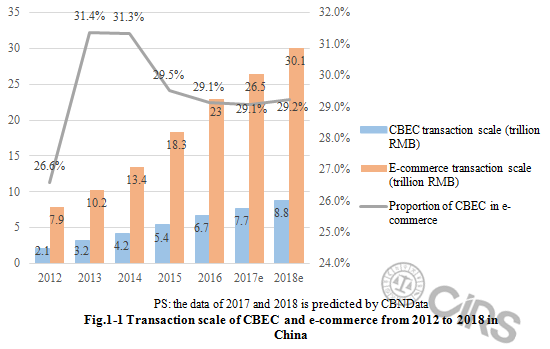

With the rapid development of e-commerce, the scale of CBEC grows as well. From 2013 to 2016, the proportion of cross-border e-commerce in the total e-commerce transaction scale has remained at a level of over 29%.

Data sources: Huayuan 2017 White Paper on CBEC

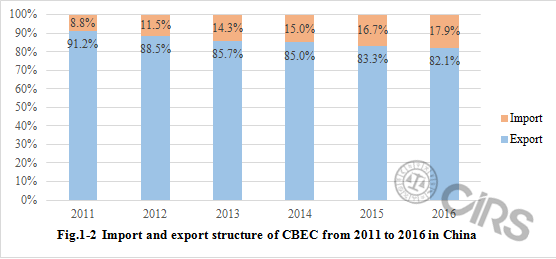

In CBEC, the proportion of import transaction scale is increasing. In 2011, it was only 8.8%, but in 2016, it reached 17.9%.

Data sources: National Bureau of Statistics, China E-commerce Research Center

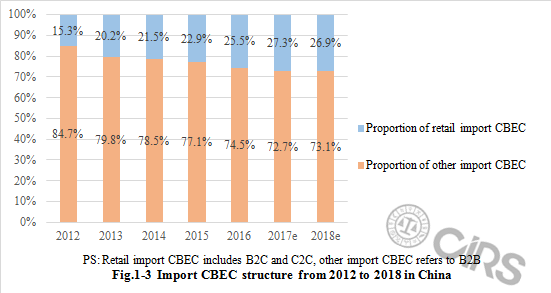

Among import CBEC, the proportion of retail CBEC is increasing. In 2013, it accounted for only 15.3%, while in 2016 it accounted for more than 25%.

Data sources: iResearch Consulting, Yiguan Analysis, China E-commerce Research Center

2. Health Food Sales Profile of Well-known E-commerce Platform (Take Tmall as an example)

2.1 Overview of Tmall GMV

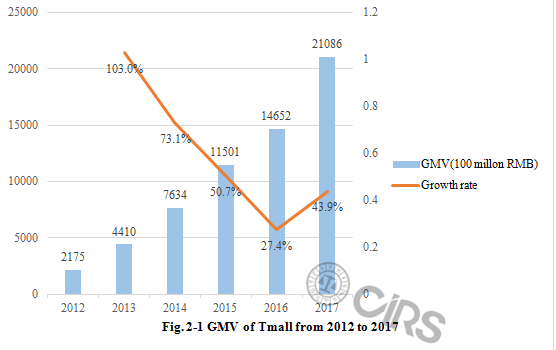

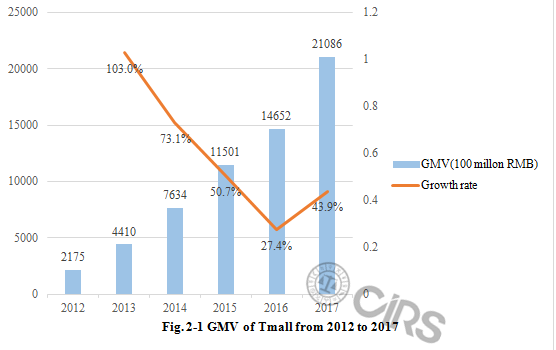

Since Taobao Mall was renamed "Tmall" in January 2012, the GMV (Gross Merchandise Volume, which includes both payment and non-payment) of Tmall has been increased from 200 billion to 2000 billion RMB in six years. The implementation of a series of measures such as improving the logistics network, promoting holiday promotions, and promoting the integration of online and offline retail has enabled the GMV growth rate to rebound in 2017, reaching 43.9%, after it fell to a low point in 2016.

Data sources: Yunguan Consulting

2.2 Tmall Health Food Data

In 2017, Tmall (including Tmall Domestic Platform and Tmall Global) health food sales were 8.31 billion, an increase of 16.9% year-on-year.

Table 2-1 Tmall health food sales annual comparison

|

Item |

2017 |

2016 |

Year-on-year growth rate |

|

Sales |

8.31 billion RMB |

7.11 billion RMB |

16.9% |

Data sources: Yunguan Consulting

According to Tmall Top 20 health food brands, the number of Chinese brands and foreign brands is the same. By-Health is the first, followed by Swisse. Of all the foreign brands on the list, three are Australian brands, the rests are American brands.

Table 2-2 Tmall Top 20 health food brands in 2017

|

Ranking |

Brand |

Sales volume (ten thousand units) |

Sales share |

|

|

1 |

By-Health (China) |

7.07 |

683 |

8.4% |

|

2 |

Swisse (Australia) |

5.60 |

478 |

6.7% |

|

3 |

Xiuzheng (China) |

3.95 |

568 |

4.7% |

|

4 |

Muscletech (America) |

2.60 |

78.5 |

3.1% |

|

5 |

Conba (China) |

2.13 |

393 |

2.5% |

|

6 |

Simeitol (China) |

1.79 |

289 |

2.1% |

|

7 |

Competitor (China) |

1.75 |

88.9 |

2.1% |

|

8 |

GNC (America) |

1.55 |

102 |

1.8% |

|

9 |

GymMax (China) |

1.55 |

84.5 |

1.8% |

|

10 |

Movefree (America) |

1.48 |

54.9 |

1.8% |

|

11 |

Blackmores (Australia) |

1.36 |

91.7 |

1.6% |

|

12 |

Centrum (America) |

1.26 |

127 |

1.5% |

|

13 |

Forrida (China) |

1.20 |

221 |

1.4% |

|

14 |

Puritan's Pride (America) |

1.14 |

86.2 |

1.4% |

|

15 |

Yangshentang(China) |

0.99 |

81.9 |

1.2% |

|

16 |

Besunyen (China) |

0.96 |

128 |

1.1% |

|

17 |

Nature's Bounty (America) |

0.85 |

106 |

1.0% |

|

18 |

0.83 |

64.1 |

1.0% |

|

|

19 |

Caltrate (America) |

0.77 |

72.9 |

0.9% |

|

20 |

Keylid (China) |

0.77 |

72.2 |

0.9% |

|

Total |

39.6 |

3870.8 |

47.0% |

|

Data sources: Yunguan Consulting

According to the Top 20 health food brands, sales of Chinese brands are 2.216 billion RMB, 27.1% higher than foreign brands, accounting for 26.20% of Tmall annual health food sales, and sales volume of Chinese brands is 26.095 million units, 106.9% higher than foreign brands. The average unit price of foreign brands is 138.27 RMB, 62.8% higher than Chinese brands.

Table 2-3 Comparison of Chinese brands and foreign brands on the Top 20 list

|

Brand |

Sales (100 million RMB) |

Sales volume (Ten thousand units) |

Average unit price (RMB) |

Sales share |

|

Chinese brand |

22.16 |

2609.5 |

84.92 |

26.20% |

|

Foreign brand |

17.44 |

1261.3 |

138.27 |

20.80% |

Data sources: Yunguan Consulting

Tmall is the e-commerce platform of the Chinese Alibaba Group, including Tmall (domestic) and Tmall Global. In 2017, Tmall captured 58% of Alibaba health food sales, the proportion in 2016 was 49%. The Tmall Global captured 18% of Alibaba health food sales, the proportion in 2016 was 13%. It seems that more consumers prefer Tmall, Tmall Global to Taobao when buying health food.

Data sources: ECdataway

According to Tmall Global Top 10 health food stores, when purchasing cross-border health food, Chinese consumers are more likely to choose the official flagship store as the purchase channel.

Table 2-4 Tmall Global Top 10 health food stores in 2017

|

Ranking |

Store |

|

1 |

|

|

2 |

|

|

3 |

|

|

4 |

Movefree Official Flagship Store |

|

5 |

|

|

6 |

Ali Health Overseas Flagship Store |

|

7 |

|

|

8 |

|

|

9 |

|

|

10 |

Puritan's Pride Overseas Flagship Store |

Data sources: ECdataway

Cross-Border E-Commerce (CBEC) has become an important channel for the sale of imported health food, particularly for new brands. In the recent years, the regulations and policies pertaining to CBEC have been changed for several times, the detailed requirement and regulatory procedures of CBEC are presented in

Section 6: Cross-Border E-Commerce (CBEC): New Opportunity for Imported Health Food to Enter the Chinese Market

of