In order toconstruct a market environment for fair competitionand promote the health development of cross-border e-commerce, MOF combined with GACC and STA published a new tax policy for cross-border e-commerce on 24 Mar, 2016. Later, for same purpose, MOF combined with GACC, AQSIQ and other government departments published an imported goods positive inventory on 6 April, 2016. Recently, the second positive inventory also released.

Background

Because of the economic growth and preferential policies for cross-border e-commerce, the Chinese cross-border e-commerce market boomed these 2 years. 15 Jun, 2015,Management Measures on Cross-Border E-Commerce Inspection and Quarantinewas published by Shanghai CIQ. This notice gave the requirements about recording enterprise in CIQ and published a negative inventory about what kind of products can’t be imported by cross-border e-commerce. 24 Nov, 2015, AQSIQ publishedStandards for Record-Keeping Management of Cross-border E-Commerce Operators and Products. This notice confirmed the specific information required for recording enterprise and products in AQSIQ.

Main contents

New tax policy

The new tax policy for cross-border e-commerce came into effect on 8 April, 2016. And the main points of this policy are as below:

1. Products imported by cross-border e-commerce will be charged import tariff, consumption tax and VAT as goods.

2. The policy only available for imported products within Positive Inventory through below modes:

1) Bonded import (BBC).

2) Direct delivery(BC)

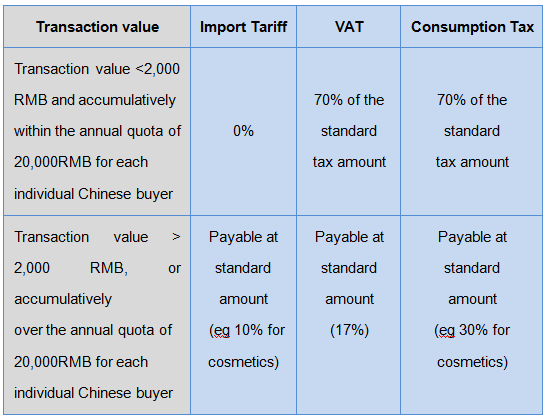

3. No import tariff when the single transaction value is below 2,000 RMB and annual transaction value does not exceed 20,000 RMB. The VAT and consumption tax will be charged 70% of the standard tax amount. Over the single value or the annual value, full tax will be charged as general trading.

The following table summarizes the change on the tax for cross-border e-commerce.

Example

-

Single transaction value <2000RMB, and annual transaction value <20,000RMB.

-

For goods bonded import or direct delivery (BBC/BC)

Note:Import tariff= Goods price *Import tariff rate;

Consumption tax =(Goods price / (1- consumption tax rate)) * consumption tax rate;

VAT = ( Goods price + Consumption tax ) * VAT rate;

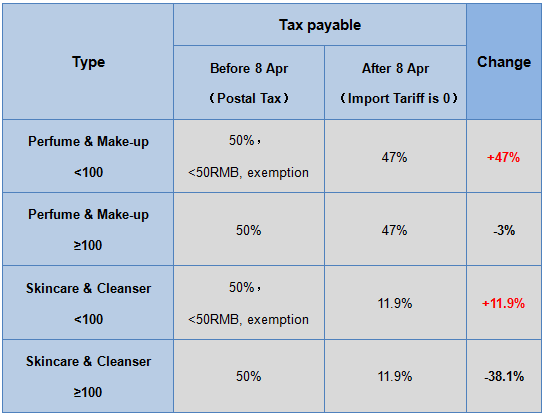

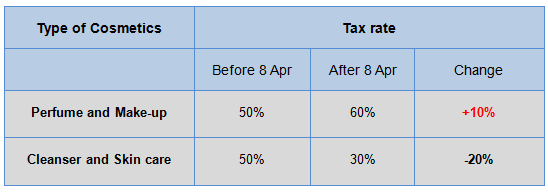

16 Mar, 2016, MOF published a notice about adjusting the postal tax for imported products. Before 8 April, 2016, postal tax was divided into 10%, 20%, 30%, 50%. After 8 April, 2016, it was adjusted to 15%, 30% and 60%.

The following table illustrates the postal tax change of cosmetics.

Positive Inventory

6 April, 2016, MOF published Product Inventory of Cross-border E-commerce through B2C. The main contents of this inventory include:

1. Only the products on the list can be imported via cross-border e-commerce.

2. Cosmetics sold by cross-border e-commerce must have been approved by CFDA before

CIRS Comments

-

The imported cosmetics sold by cross-border e-commerce should be included in Positive Inventory.

-

The registration of first-time imported cosmetics with CFDA is compulsory before sold by cross-border e-commerce.

-

Given that the approval imported cosmetics are public on the official website of CFDA, so it is necessary to check registration status before import by cross-border e-commerce

Related information

CIRS will hold 2nd Shanghai Summit Meeting on Cosmetics Regulations in Asia-pacific on 28-29th Jun. We invite an official Ms. Sun Jiawen from Shanghai Entry-Exit Inspection and Quarantine Bureau to make a presentation about the Supervision of E-commerce Market for Imported Cosmetics in China.

Source

1. Notice about a new import tax policy for cross-border e-commerce

http://gss.mof.gov.cn/zhengwuxinxi/zhengcefabu/201603/t20160324_1922968.html

2. Notice about tax adjustment for imported articles

http://gss.mof.gov.cn/zhengwuxinxi/zhengcefabu/201603/t20160324_1922971.html

3. New tax policy for cross-border e-commerce and adjusted postal tax will take into effect from 8 April 2016.

http://gss.mof.gov.cn/zhengwuxinxi/gongzuodongtai/201603/t20160324_1922972.html

4. List of cross-border e-commerce imported articles has been published

http://gss.mof.gov.cn/zhengwuxinxi/zhengcefabu/201604/t20160401_1934275.html

5. Product specification in List of cross-border e-commerce imported article

http://gss.mof.gov.cn/zhengwuxinxi/zhengcejiedu/201604/t20160413_1948854.html

Download

Requirements for the Management of Online Cosmetics in China

http://freedoc.hfoushi.com/en/downloads/cosmetics/Management_of_Online_Cosmetics.html