According to statistics, 4,515 pesticides have been newly registered in 2018, growing 15.38% year over year compared with 2017. Type of pesticide registration has still been dominated by field pesticides, and the plant growth regulator has showed strong momentum. Suspension concentrate has been dominant in registration of all formulation types. The oil-based suspension concentrate, granule and micro-emulsion registrations have increased significantly compared with 2017. Change in the quantity and structure of China pesticide registration in 2018 is closely related to implementation of new policies and market demands. Hangzhou REACH Technology Group Co., Ltd. (hereinafter referred to as CIRS) has summarized data on China pesticide registration in 2018, and analyzed it from multiple aspects, expecting to provide reference for future pesticide registration of companies.

1. Statistics by category of pesticide registration

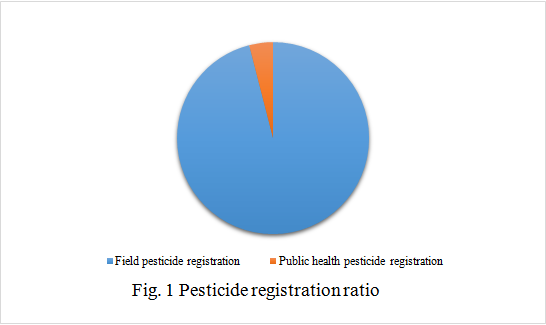

The new edition of Regulation on Pesticide Administration cancels the provisional registration and repacking registration, and only retains the original official registration. Official registration consists of field pesticide and public health pesticide registration. Among them, field registration is represented by "PD" and public health pesticide registration is represented by "WP".

4,515 pesticides have been newly registered in 2018, including 4,326 field pesticide registrations which account for 96%, a year-on-year increase of 28.56% (compared with 2017 herein); 189 public health pesticide registrations which account for 4%, a year-on-year increase of 23.53 %, as shown in Fig. 1.

2. Statistics by pesticide category

Based on the prevention & control target or range of application, the pesticides can be classified as insecticide, fungicide, herbicide, plant growth regulator and public health pesticide. Statistics on pesticide categories in 2018 are as shown in Fig. 2. We can see that there are 1,680 herbicides registered, accounting for 37%, a year-on-year increase of 18%; 1181 fungicides registered, accounting for 26%, a year-on-year increase of 0.4%; 1179 insecticides registered, accounting for 26%, a year-on-year increase of 26%; 188 public health pesticides registered, accounting for 4%, a year-on-year increase of 15%; 178 plant growth regulators registered, accounting for 4%, a year-on-year increase of 44%; 109 other pesticide registered, accounting for 2%.

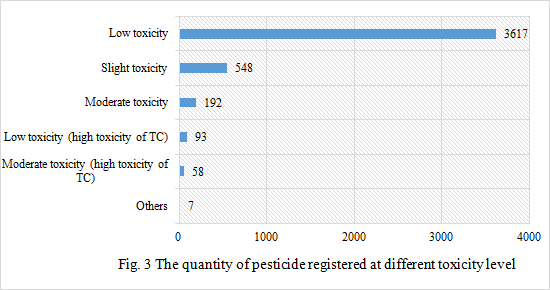

3. Statistics by toxicity

Toxicity of the pesticide registered is mainly divided into slight toxicity, low toxicity, moderate toxicity, low toxicity (high toxicity of technical (TC)) and moderate toxicity (high toxicity of TC). Statistics on toxicity of pesticide registered in 2018 are shown in Fig. 3. We can see that there are 3,617 pesticides with low toxicity, accounting for 80%, a year-on-year increase of 15%; 548 pesticides with slight toxicity, accounting for 12%, a year-on-year increase of 25%; 192 pesticides with moderate toxicity, accounting for 4%, a year-on-year increase of 1%; 93 pesticides with low toxicity (high toxicity of TC), accounting for 2%, a year-on-year decrease of 11%; 58 pesticides with moderate toxicity (high toxicity of TC), accounting for 1%, a year-on-year increase of 57%; 7 other pesticides.

Note: Others refer to moderate toxicity (high toxicity of TC), low toxicity (high toxicity of TC), low toxicity (moderate toxicity of TC), high toxicity and slight toxicity (high toxicity of TC).

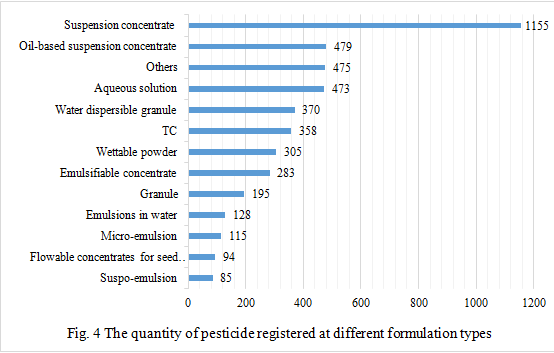

4. Statistics by formulation type

The formulation type of pesticide product registered in 2018 is shown in Fig. 4. As shown in Fig. 4, there are 1,155 suspension concentrates registered, accounting for 26%, a year-on-year increase of 18%; 479 oil-based suspension concentrates registered, accounting for 11%, a year-on-year increase of 64%; 473 aqueous solutions registered, accounting for 11%, a year-on-year increase of 15%; 370 water dispersible granules registered, accounting for 8%, a year-on-year decrease of 4%; 358 technical materials(TCs) registered, accounting for 8%, a year-on-year decrease of 14%; 305 wettable powders registered, accounting for 7%, a year-on-year increase of 2%; 283 emulsifiable concentrates registered, accounting for 6%, a year-on-year increase of 37%; 195 granules registered, accounting for 4%, a year-on-year increase of 43%; 128 emulsions in water registered, accounting for 3%, a year-on-year decrease of 4%; 115 micro-emulsions registered, accounting for 3%, a year-on-year increase of 19%; 94 flowable concentrates for seed coating registered, accounting for 2%, a year-on-year decrease of 19%; 85 suspo-emulsions registered, accounting for 2%, a year-on-year increase of 42%.

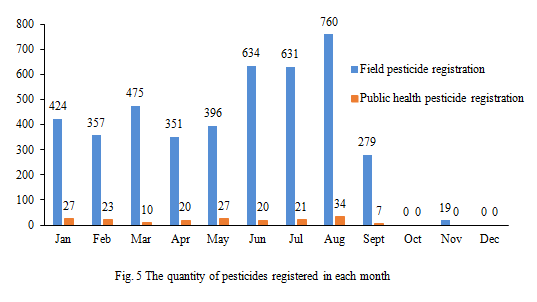

5. Statistics by months

Fig. 5 is the monthly statistical chart of pesticides newly registered in 2018. 760, 634 and 631 field pesticide registered are approved in August, June and July respectively, ranking the top three and accounting for 18%, 15% and 15% in order; 34, 27, and 27 public health pesticide registered are approved in August, May and January respectively, accounting for 18%, 14% and 14% and ranking the first and second in the quantity of public health pesticide registered.

6. Top 10 domestic manufacturers in pesticide registration

See Table 1 for top 10 domestic manufacturers in registration in 2018. Shandong Aokun Biological Co., Ltd., Zhejiang Tianfeng Biological Science Co., Ltd. and Zhejiang Zhongshan Chemical Industry Group Co., Ltd. have 58, 51 and 45 registrations respectively, ranking the top three.

Table 1 Top 10 domestic manufacturers in pesticide registration

|

No . |

Manufacturer |

Quantity |

|

1 |

Shandong Aokun Biological Co., Ltd. |

58 |

|

2 |

Zhejiang Tianfeng Biological Science Co., Ltd. |

51 |

|

3 |

Zhejiang Zhongshan Chemical Industry Group Co., Ltd. |

45 |

|

4 |

Shaanxi Meibang Pesticide Group Co., Ltd. |

43 |

|

5 |

Jiangxi Zhonghe Chemical Co., Ltd. |

34 |

|

6 |

Foshan Yinghui Crop Science Co., Ltd. in Guangdong Province |

33 |

|

7 |

Henan Hansi Crop Protection Co., Ltd. |

32 |

|

8 |

Shandong Qiaochang Chemical Co., Ltd. |

31 |

|

9 |

Jiangsu Huifeng Bio Agriculture Co., Ltd. |

31 |

|

10 |

Shaanxi Hengtian Biological Agriculture Co., Ltd. |

31 |

7. Top 3 foreign manufacturers in pesticide registration

See Table 2 for top 3 foreign manufacturers in 2018 pesticide registration. BASF SE has registered 9 pesticides, the highest one. Compared with 2017, the quantity of pesticide registered has increased, but it is still dominated by field pesticides.

Table 2 Top 3 foreign manufacturers in pesticide registration

|

No. |

Manufacturer |

Quantity |

|

1 |

BASF SE |

9 |

|

2 |

United Phosphorus Limited |

7 |

|

3 |

Bayer Cropscience Co., Ltd. |

6 |

8. Active ingredients of Top 10 domestic manufacturers

Active ingredients are specific chemical components or organisms biologically active against pests such as diseases, insects, weeds and rats etc. in the pesticide product. The active ingredients of top 10 domestic manufacturers in registration of 2018 are shown in Table 3. As shown in Table 3, 253 pyraclostrobins, 193 Glufosinate ammoniums and 192 penoxsulams have been registered, ranking the top three.

Table 3 Active ingredients of Top 10 domestic manufacturers in registration

|

No. |

Active ingredient |

Quantity |

|

1 |

Pyraclostrobin |

253 |

|

2 |

Glufosinate ammonium |

193 |

|

3 |

Penoxsulam |

192 |

|

4 |

Dinotefuran |

166 |

|

5 |

Abamectin |

160 |

|

6 |

Glyphosate |

145 |

|

7 |

Atrazine |

137 |

|

8 |

Thiamethoxam |

128 |

|

9 |

Cyhalofop-butyl |

123 |

|

10 |

Tebuconazole |

119 |

9. Registered for the first time in 2018

9.1 Active ingredients

15 active ingredients registered for the first time in 2018 include thymo, E-8-dodecen-1-yl acetate, s-methoprene, quintrione, bis-carfentrazone-ethyl, diclosulam, propaquizafop, paenibacillus polymyxa KN-03, isotianil, allyl isothiocyanate, pyridoprim , bacillus methylotrophicus, cnaphalocrocis medinalis granulovirus, (Z,E)-9,12-tetradecadienyl acetate and dicamba isopropylamine salt.

9.2 Crop and prevention & control target

11 crops registered for the first time in 2018 include the coffee tree, Poa pratensis L., apricot, Eucalyptus forest, rice field by mechanically transplanting seedlings, tomato (greenhouse), nursery (Ligustrum lucidum), nursery (hybrida vicary privet), lotus root field, ornamental ophiopogon japonicus and beans.

2 prevention & control targets registered for the first time in 2018 include anthrax leaf blight and bacterial leaf spot.

CIRS's view

According to requirements of the new regulations, the new Data Requirements on Pesticide Registration has been implemented since November 1, 2017. The old Data Requirements on Pesticide Registration(Directive No. 10 of the Ministry of Agriculture of the People's Republic of China) issued on December 8, 2007 was still implemented for pesticide registration data submitted before November 1, 2017. Therefore, a lot of companies choose to submit data before the deadline for the implementation of the new regulation, especially on October 31. This is also one of the important reasons for significant increase in the quantity of pesticides newly registered in 2018 compared to 2017.

Active ingredient

Pyraclostrobin and glufosinate-ammonium have been ranking the first and second for 2 consecutive years and continue to rise. Atrazine and avermectin also increase at different levels. The quantity of glyphosate, tebuconazole and thiamethoxam registered has changed little compared with 2017. Among them, tebuconazole shows strong advantage in registration ranking of pesticide active ingredient in domestic and foreign manufacturers.

Pesticide category

The quantity of herbicides registered is the highest. As the plant growth regulator is in conformity with the principle of improving quality, protecting the environment and promoting sustainable agricultural development, it shows a stronger upward trend and increases by 44% compared with 2017. Plant growth regulators are mainly represented by 24-epibrassinolide, gibberellic acid, paclobutrazol and tribenuron-methyl.

Formulati on type

Suspension concentrate has the advantages of wettable powder and emulsifiable concentrate due to its small particle size, strong penetrability, free of dust, little pollution, high efficacy and low cost. The quantity of suspension concentrate registered has ranked first for two consecutive years, and continues to increase. Suspension concentrate is a widely used formulation type currently. The oil-based suspension concentrate, emulsifiable concentrate, granule, suspo-emulsion and micro-emulsion increase significantly compared to 2017. Among them, as a new formulation type in the GB/T 19378-2017 Nomenclature and codes of pesticide formulations(hereinafter referred to as the new standard) implemented on May 1, 2018, the oil-based suspension concentrate increases by as much as 64%, accounting for the highest rate. The registration of emulsifiable concentrate, granule, suspo-emulsion and micro-emulsion also increases at different levels than that of 2017. The new standard cancels the formulation types of "flowable concentrates for seed coating and aqueous solution", and the applicant can register the products as "flowable concentrate for seed treatment and soluble concentrate" instead, under the circumstance of not changing the product composition. The formulation type of aqueous solution increases compared with 2017, while the registration of flowable concentrates for seed coating drops by as much as 19%.

Currently, the new regulations on pesticides have been implemented. All companies should prepare data according to the new Data Requirements on Pesticide Registration and other laws and regulations for a long period of time. This is both an opportunity and a challenge for companies. It is estimated that the pesticide registration will fall in 2019, this is not only the result caused by extensive development of the pesticide industry, but also the inevitable result of market transition and national policy reform. The new policies substantially change the pesticide management system, pesticide registration and licensing system, supervision means of the agricultural sector and punishments for illegal act. Companies can take advantage of the opportunity to further integrate resources based on extensive development in the early stage, implement the idea of green development and produce products meeting the requirements of the market and national policies, so that they can maintain long-term development.

If you have any needs or questions, please contact us at service@hfoushi.com.